13.02.2017

Minimum Wages Lok Sabha Question & Answer

GOVERNMENT OF INDIA

MINISTRY OF LABOUR AND EMPLOYMENT

LOK SABHA

STARRED QUESTION NO.48

TO BE ANSWERED ON 06.02.2017

MINIMUM WAGES

48. SHRI KUNWAR PUSHPENDRA SINGH CHANDEL:

PROF. RAVINDRA VISHWANATH GAIKWAD:

PROF. RAVINDRA VISHWANATH GAIKWAD:

Will the Minister of LABOUR AND EMPLOYMENT be pleased to state:

(a)whether the Government proposes to amend the Minimum Wages Act, 1948 and formulate a uniform wage policy for the entire country and if so, the details and salient features thereof;

(b)whether minimum wages fixed under the Minimum Wages Act, 1948 varies amongst States;

(c)if so, the details thereof, State/UT-wise along with the reasons for differential wages especially on gender basis and also between urban and rural areas;

(d)whether any monitoring mechanism exists to ensure that all the workers are paid minimum wages and not subjected to any form of exploitation; and

(e)if so, the details thereof along with other labour welfare measures being implemented by the Government for betterment of labour force in the country?

ANSWER

MINISTER OF STATE (IC) FOR LABOUR AND EMPLOYMENT

(SHRI BANDARU DATTATREYA)

(a) to (e): A statement is laid on the table of the House.

STATEMENT REFERRED TO IN REPLY TO PARTS (a) TO (e) OF THE LOK SABHA STARRED QUESTION NO. 48 FOR 06.02.2017 BY SHRI KUNWAR PUSHPENDRA SINGH CHANDEL AND PROF.RAVINDRA VISHWANATH GAIKWAD REGARDING MINIMUM WAGES.

(a): The proposed amendments to the Minimum Wages Act, 1948, inter-alia, includes applicability of minimum wages to all employments, changes in the definition of “Appropriate Government”, fixation/review/revision of minimum rates of wages by the State Government, introduction of National Minimum Wage by the Central Government, enhancement of penalty, etc.

As a step towards a uniform wage structure, the concept of National Floor Level Minimum Wage (NFLMW) was introduced by the Government in 1996 on a voluntary basis. It is revised from time to time taking into account the increase in the Consumer Price Index Number. NFLMW has been revised to Rs.160/- per day w. e. f 01.07.2015.

(b) & (c): Under the provisions of the Minimum Wages Act, 1948, both Central and State Governments are appropriate Governments to fix, review and revise the minimum wages of the workers employed in the scheduled employment under their respective jurisdictions. As regards minimum wages in States, there is disparity due to variations in socio-economic and agro-climatic conditions, income, prices of essential commodities, paying capacity, productivity and local conditions. As per the available information, a statement showing the range of rates of minimum wages in all the States/Union Territories is at Annexure.

The Act does not discriminate on the basis of gender and the female workers are entitled to same wages and other facilities as fixed by the Central Government for the workers engaged in the scheduled employments. No separate wages are fixed for urban and rural areas.

(d) & (e): The implementation of the Act is carried out by the Centre as well as the States in respect of their respective jurisdiction. In the Central Sphere, the enforcement is secured through the Inspecting Officers of the Chief Labour Commissioner (Central) commonly designated as Central Industrial Relations Machinery (CIRM), the compliance in the State sphere is ensured through the State Enforcement Machinery. They conduct regular inspections and in the event of detection of any case of non-payment or under-payment of minimum wages, they advise the employers to make payment of the shortfall of wages. In case of non-compliance, penal provisions against the defaulting employers are invoked.

The labour welfare measures recently initiated for betterment of labour force include minimum pension of Rs.1000/-per month to the pensioners under Employees’ Pension Scheme (EPS), 1995, portability of provident fund account, National Career Service portal, Employees State Insurance Corporation 2.0(Health Reforms of ESIC), Revision in eligibility and calculation ceiling under the Payment of Bonus Act, 1965 etc.

PDF /WORD (English)

672. DR. SHASHI THAROOR:

Will the Minister of LABOUR AND EMPLOYMENT be pleased to state:

(a)whether the Government proposes to extend the time span of the compulsory paid maternity leave from 12 weeks to 26 weeks in private organizations;

(b)if so, the details thereof;

(c)whether the Government also proposes to amend section 4 of the Maternity Benefits Act, 1961, to ensure that women employed in various public sector undertakings receive the same benefit; and

(d)if so, the details thereof and if not, the reasons therefor?

(a) & (b): Yes, Madam. The Government has decided to enhance the paid maternity leave from existing 12 weeks to 26 weeks and an Amendment Bill in this regard was introduced in the Rajya Sabha. The Rajya Sabha has already passed the Bill on 11.08.2016. With regard to women workers covered under Employees’ State Insurance Act, 1948, such enhancement has already been effected by amending the ESI (Central) Rules,1950.

(c) & (d): There is no proposal to amend Section 4 of the Maternity Benefit Act, 1961. The benefits under this Act are already applicable and available to women employed in various public sector undertakings.

PDF/WORD (English)

Maternity Leave Lok sabha Question & Answer

GOVERNMENT OF INDIA

MINISTRY OF LABOUR AND EMPLOYMENT

LOK SABHA

UNSTARRED QUESTION NO. 672

TO BE ANSWERED ON 06.02.2017

MATERNITY LEAVE

Will the Minister of LABOUR AND EMPLOYMENT be pleased to state:

(a)whether the Government proposes to extend the time span of the compulsory paid maternity leave from 12 weeks to 26 weeks in private organizations;

(b)if so, the details thereof;

(c)whether the Government also proposes to amend section 4 of the Maternity Benefits Act, 1961, to ensure that women employed in various public sector undertakings receive the same benefit; and

(d)if so, the details thereof and if not, the reasons therefor?

ANSWER

MINISTER OF STATE (IC) FOR LABOUR AND EMPLOYMENT

(SHRI BANDARU DATTATREYA)

(c) & (d): There is no proposal to amend Section 4 of the Maternity Benefit Act, 1961. The benefits under this Act are already applicable and available to women employed in various public sector undertakings.

PDF/WORD (English)

Launch of National Career Service (NCS) & Jeevan Pramaan Facility for EPFO pensioners through Post Offices by Hon'ble Union Minister of State (I/C) for Labour & Employment Shri Bandaru Dattatreya Indiapost, Hyderabad.

Shrink your Postal address to six characters with eLoc

The typical postal address is a few lines long. Now, you can shrink it into just six characters — no matter how long and complicated it is — and share with anyone who can find the building, business or even your home that it represents with almost pinpoint accuracy.

More than eight years after it started working on it, digital mapping company MapmyIndia formally launched eLoc (short for e-Location) on Thursday. For now, it is a free service.

It shortens an address into a combination of six alphabets and numbers. You can put it on your visiting card, on a website or share via any other means. If someone is looking to reach you, the person needs to just enter the eLoc in MapmyIndia's maps portal (or app) and it will instantly offer turn-by-turn directions right up to your address.

The closest to eLoc, in a context that everyone can understand, is our PIN code. The problem with the PIN code is that it specifies an area that could as large as 50 square kilometres. An eLoc, on the other hand, can guide the user right up to the address.

If you're reading this, chances are that the eLoc for your address has already been created. You can head over to www.mapmyindia. com/eloc and check. Once you have your eLoc (ABC123 for example), you can also share a short URL to it, which will be //eloc.me/ABC123. Clicking the link will open MapmyIndia's maps in a web browser and show you the precise location. If you don't have an eLoc, you can right click on the map and create one.

Apart from consumer use, businesses and government services, too, could benefit from eLoc. Taxi aggregators, emergency services, local deliveries, courier services, property administration, postal services and others can all use it.

"Just like Aadhaar is the identity of a person, eLoc is the identity of an address or a business," said Rakesh Verma, managing director of MapmyIndia. "Over 2 crore (20 million) eLocs have been generated already and, apart from the address, it can also include more information about a business."

When asked about monetising the eLoc, he said: "Initially, we want to do whatever it takes to get the maximum number of people to start using it. At some point, business will start benefiting from eLocs and that's when we will look at monetising. We want to take the total 20 million eLocs to about 100 million — as we keep building house addresses, the eLoc database will be built alongside."

Source : The Times of India

Sukanya Samriddhi Account ( SSA ) deposits eligible for deduction u/s 80C of Income Tax Act, 1961

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

NOTIFICATION NO. 09/2015

INCOME-TAX

21 st January, 2015

In exercise of the powers conferred by clause (viii) of sub-section (2) of section 80C of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby specifies the “Sukanya Samriddhi Account” for the purposes of the said clause.

This notification shall come into force with effect from the date of its publication in the Official Gazette. [ F. NO. 178/3/2015-ITA-1 ]

The Fundamental (Amendment) Rules, 2017

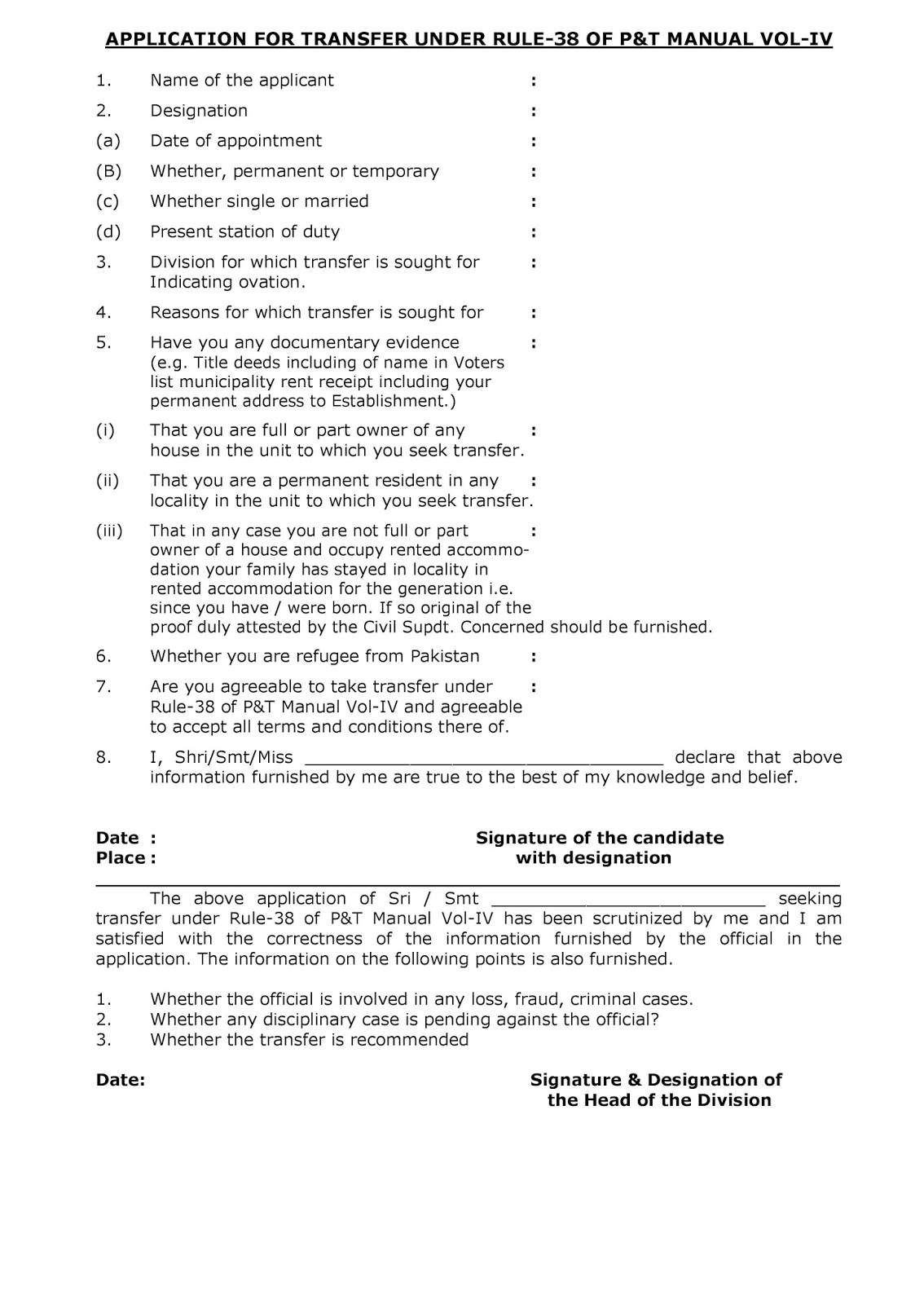

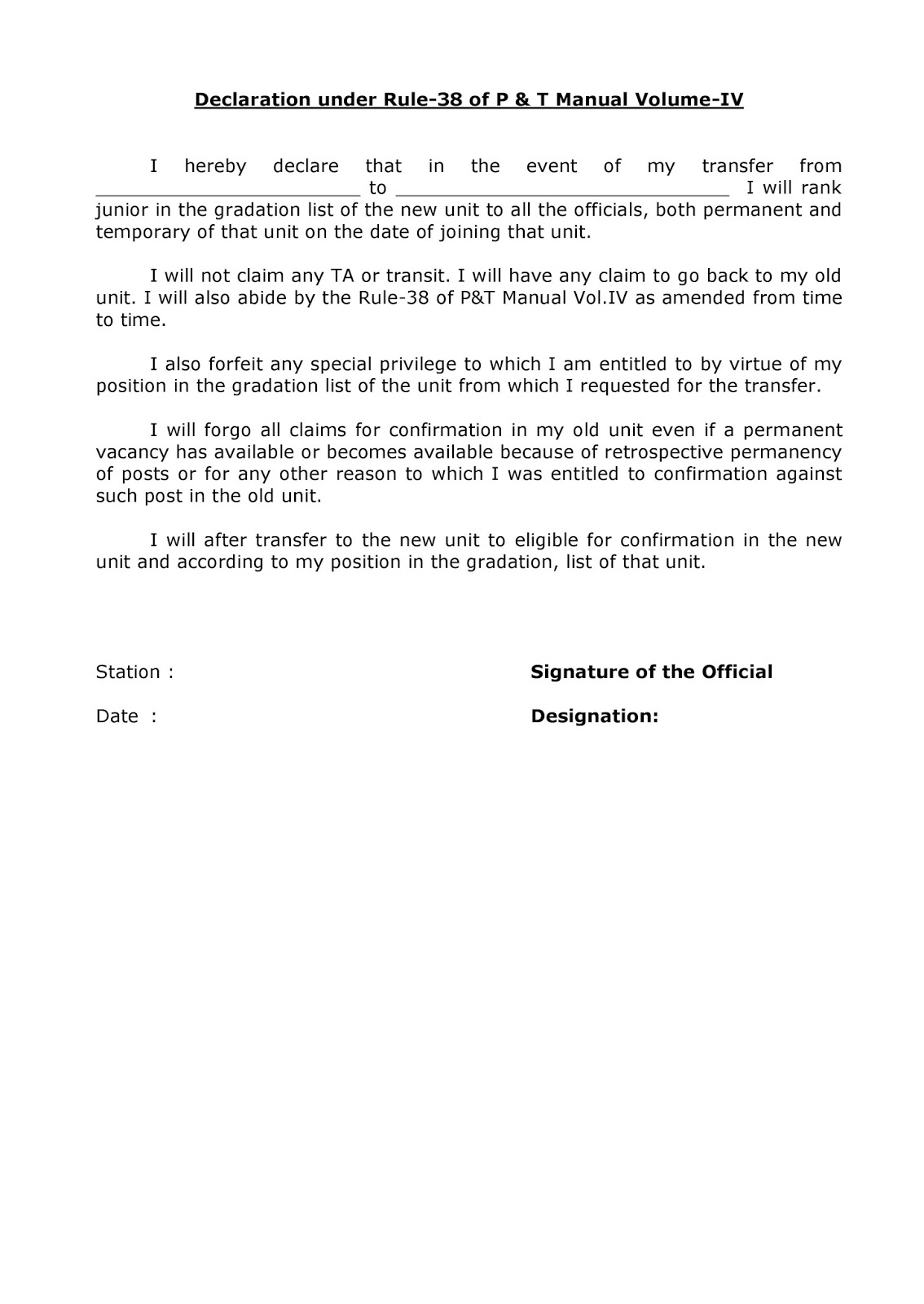

Rule 38 transfer - Application Form